Creditors use your credit score to decide whether to give you a loan or not. They also use it to determine the interest rate to charge you depending on the risk assessment from your credit history. However, due to a lack of understanding on how the credit score is calculated using the FICO traditional method, which is the most common, many myths have come about on what can hurt your credit rating. For example, the common belief that having zero balance on all your credit cards can lower your score is untrue. However, if you do not use your card for long, the card issuer may close that account. Even if that account may be on your credit history for about 10 years, its ultimate removal will reduce the length of your credit history, most likely lowering your score.

Here are some things that do not hurt your credit score:

Paying your rent, telephone, and utility bills late

Landlords do not normally share payment information with credit bureaus. The same case applies to cellphone service providers as well as utility suppliers. As such, late or missed payment of your rent, cellphone bills, and utility bills will not hurt your score. However, if your landlord or cellphone and utility service providers hand over the overdue payments to collection agencies, this can adversely affect your score.

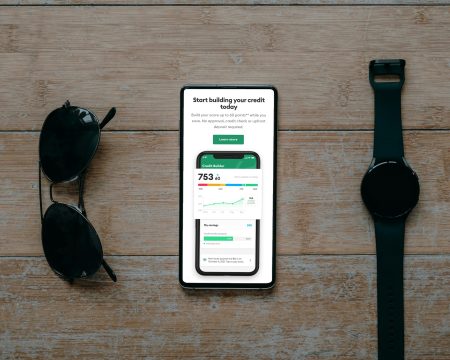

So, is all lost if your score has been damaged by such circumstances? No, in fact, there are some ways to repair your score, and one of them is to engage experts who help to improve credit rating using credit lines. You can find such experts at https://www.boostcredit101.com.

Keeping your credit card dormant for a long time

Letting your credit card remain idle for a long time will not hurt your credit rating, contrary to popular belief. However, you should note that your card issuing company may decide to close the card as a result of inactivity. The closure of any card account will likely lower your score, as that credit line will be dropped over time from your credit report, thus shortening your credit history.

Soft pulls

A soft pull is an inquiry that is not aimed at seeking credit. An example of a soft pull is when you request a copy of your credit report, or when you inquire about your credit score. It is crucial to keep monitoring your credit report to pick out errors and wrong reports, and to have them rectified to avoid damaging your score. Other cases of soft inquiry include when credit card providers and lenders make an inquiry on your credit for promotional purposes, or if they check on your accounts with them.

Losing your job

Without a steady income, you may not have your loans or credit card applications approved. However, your job status is an immaterial factor when it comes to your credit score. The computation of the score, be it using FICO or any other formula, does not take into account your pay, occupation, employer, or position or title.

Credit counseling

You may have to seek a credit counselor’s professional assistance if you are up to your neck in debt. This is almost like declaring bankruptcy, since you are accepting that handling your liabilities on your own is a challenge. However, signing up for credit counseling is dissimilar from bankruptcy, as the former does not appear on your credit history and thus does not affect your score.