There is little doubt that a poor credit rating will severely limit your borrowing options. County Court Judgments (CCJs), defaulted payments and bankruptcy orders will leave a black mark against your name which will be impossible for lenders to overlook when trying to secure new credit.

In addition, if you miss credit card payments, direct debits for energy bills etc, you will also find that your credit file receives a black mark which will cause problems when applying for a new form of credit.

Slippery Slope

The first step onto a slippery slope can often be when you submit an application for a form of credit and get turned down. The first thought for many people is to apply somewhere else but this is often the worst thing that you can do as credit rejections will leave a negative imprint on your credit file which will make matters worse if they begin to accumulate.

Taking steps towards improving your credit rating and keeping it to an acceptable level may take a little while but they will help you stay away from that slippery slope.

Credit Agencies

The majority of lenders go through two main credit reference agencies for information related to the financial history of the applicant – Experian and Equifax, with a third less frequently used credit agency called CallCredit.

These credit agencies compile credit histories from a number of sources, including the electoral roll, County Court Judgments and how effectively past debts have been paid.

Every time you open a new form of credit it will leave an electronic footprint on your record. The decision to turn borrowers down for credit isn’t made by Experian or Equifax but by the lenders, based on their own criteria. Although you may find the lender simply tries to tell you that you need to speak to the credit agency.

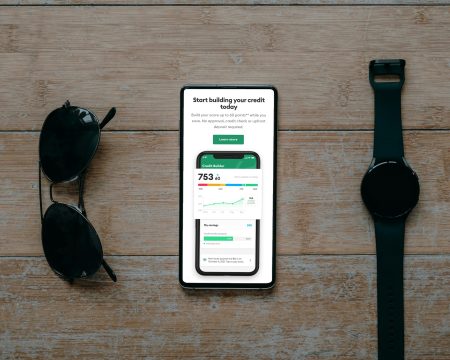

What Can I Do To Improve My Credit Score?

Taking steps towards improving your credit rating may not be as difficult as you imagine as there are some basic checks which can be taken which are proven to help. These include:

- Ensure all outstanding debts are registered to your correct name and current address

- Contact a credit agency to make sure that there are no mistakes on your credit file

- Ensure you are registered on the electoral roll for your current address.

- Limit the amount of applications your make for new lines of credit. Too many applications will be viewed as an act of desperation, not a positive thing in the eyes of reputable lenders!

- Only apply for credit where necessary and wherever possible request a ‘quotation search’ – asking for a rate first – rather than a ‘credit search’.

- Show lenders that you are a responsible borrower by borrowing and paying it back.

- Keep clearing outstanding balances. At least 6 months worth of only spending small amounts and then clearing the balance, thereby not being charged interest will have a significant effect on your credit rating.

- Do everything in your power to keep up all outstanding repayment schedules

- Close down any credit agreements you no longer use.

Following these tips will not only help you to improve your credit rating, continued use will also help you to keep it in a healthy state.

What Are My Options?

All of the tips outlined above will provide long term results but what if you need something to help you in the short term? Whilst high street lenders will generally not be prepared to look past the credit rating/history of an applicant, the chances of obtaining credit by borrowers with poor credit ratings through what is known as the sub-prime market is greatly increased. This market enables would-be borrowers to successfully apply for a loan but will be charged high rates of interest to reflect the perceived risk to the lender.

No credit checking loans such as Guarantor Loans are available because the risk to the lender is reduced by the presence of someone who will step in to make repayments should the borrower fail to do so. As well as offering a realistic option in regard to new credit, a successful application and a demonstration of being able to make repayments as scheduled will go a long way towards getting your credit rating back on track.