Mental health is taking up a big percentage of disability insurance claims in Canada. Anxiety, depression, burnout, and stress-related disorders affect a growing number of working Canadians and frequently lead…

Personal Finance

Life does not always go the way we plan. Maybe you lost your job. Maybe…

Ever caught yourself wondering how to fund your great business ideas? Do not worry, you…

Let us be real, money is scary. From trying to decipher investment jargon to simply…

Having a house may sound exciting, but it has a lot of responsibility attached to…

Trending Now

Bitcoin’s 2009 launch aimed to completely transform how individuals could access and manage their financial…

If you have made a few investments and had some success, you may be wondering…

In recent years, PAMM (Percentage Allocation Management Module) investments have experienced a surge in popularity…

Investments offer one of the most valuable tools for those who want to start creating…

News Focus

View MoreMental health is taking up a big percentage of disability insurance claims in Canada. Anxiety,…

Everyone at some point worries about what might happen to their loved ones if anything…

Recent Posts

Social media company X has been hit with a €120 million ($140 million) fine by the European Commission for breaking transparency rules. This is…

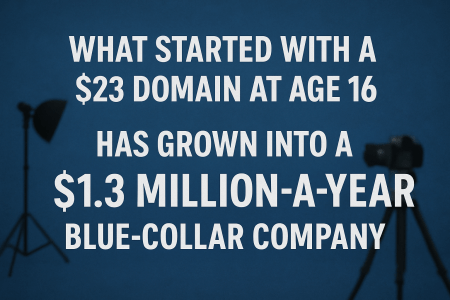

At just 16 years old, Singapore teen entrepreneur Zames Chew spent only 30 Singapore dollars (about 23 U.S. dollars) to buy a website domain…

Everyone at some point worries about what might happen to their loved ones if anything happens to them. Life insurance happens to be one…

In today’s fast-paced world, keeping track of your finances, including your credit card balance, is essential to staying on top of your financial goals.…

The UAE Central Bank (CBUAE) is getting ready to introduce its Central Bank Digital Currency (CBDC), the “Digital Dirham,” by late 2025. The digital…

Revolut, one of Europe’s most valuable fintech companies, is thinking about buying a U.S. bank as part of its big plans for international growth.…

Latest Posts

Subscribe to Updates

Get the latest news.