Hybrid or balanced funds have become a popular investment choice for many individuals seeking a balance between risk and return. They offer a blend of equity and debt investments, aiming to provide some of the growth potential of stocks with the stability of bonds. These funds are often divided into two categories: debt-oriented and equity-oriented. Which type is best for you is determined by your specific investing objectives and risk tolerance. Let us explore these areas further so you can make an informed selection.

Hybrid Funds Overview

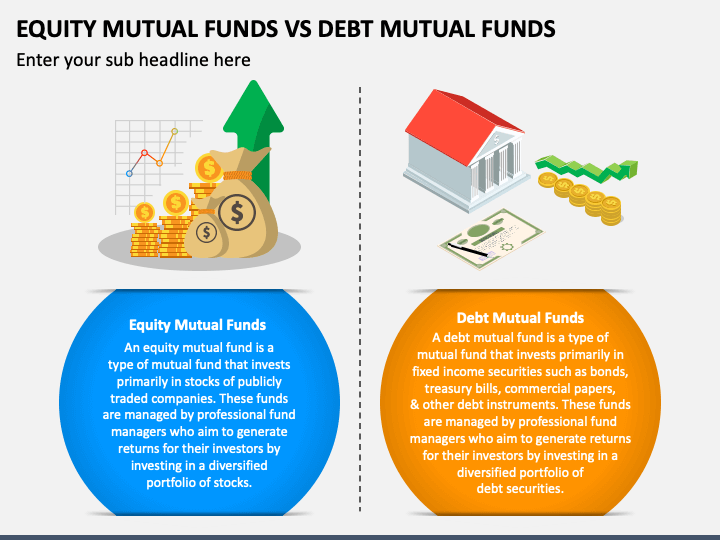

Hybrid funds invest in a predetermined mix of equity and debt instruments. The specific allocation varies depending on the fund’s category. As the name suggests, debt-oriented hybrid funds lean more towards debt securities, typically with an equity allocation of 60-75%. Equity-oriented hybrid funds, on the other hand, have a higher equity weightage, ranging from at least 65% or even more. This difference in allocation significantly impacts the risk-return profile of each type of fund.

Hybrid Funds have the advantage of providing intrinsic asset allocation. Hybrid Funds invest in many asset classes, including equities, debt, gold, and overseas ETFs. Because the prices of various asset types move in opposing directions, your portfolio’s risk decreases.

Source: Sketch Bubble

Debt-Oriented Hybrid Funds

Debt-oriented hybrid funds prioritize income generation and capital preservation. Their higher allocation to debt instruments like government bonds, corporate bonds, and debentures translates to lower volatility than equity-oriented options. This makes them suitable for risk-averse investors or those with shorter investment horizons, such as those saving for a down payment on a house.

Pros:

- Lower volatility: The debt component acts as a buffer, mitigating the sharp swings often experienced in the stock market.

- Regular income: Debt instruments typically provide regular coupon payments, offering a steady income stream.

- Tax advantage: Debt-oriented funds are taxed more favorably than equity funds in some countries.

Cons:

- Lower growth potential: Debt investments generally offer lower returns compared to equities.

- Interest rate risk: Bond prices and interest rates have an inverse relationship. When interest rates rise, bond prices fall, potentially affecting the fund’s value.

Equity-Oriented Hybrid Funds

Equity-oriented hybrid funds aim for capital appreciation over the long term through their higher equity allocation. This translates to greater growth potential compared to debt-oriented funds but also comes with increased volatility. These funds suit investors with a longer investment horizon (ideally five years or more) and a higher risk tolerance. They generally invest at least 65% of their assets in equities and equity-linked products, to capitalize on stock market gains. The remaining 35% is invested in debt instruments such as bonds, which serve as a buffer and help stabilize the fund’s overall volatility compared to pure equities funds.

Pros:

- Higher growth potential: Equities have the potential to generate significantly higher returns over the long term compared to debt instruments.

- Portfolio diversification: Hybrid funds offer diversification across asset classes, mitigating risk compared to pure equity investments.

Cons:

- Higher volatility: Equity markets can be volatile, leading to fund value fluctuations.

- Lower income: Equity-oriented funds may provide some dividend payouts, but the focus is on capital appreciation rather than regular income.

Choosing Between Debt-Oriented and Equity-Oriented Hybrid Funds

The decision between a debt-oriented and equity-oriented hybrid fund refers to your circumstances and financial goals. Here are some key factors to consider:

- Financial goals: Are you saving for retirement, a child’s education, or a down payment? Your goals will influence your risk tolerance and investment horizon.

- Age: Generally, younger investors have a longer time horizon and can tolerate more risk. You may want to shift towards a more conservative allocation as you approach retirement.

- Risk tolerance: How comfortable are you with potential losses? A debt-oriented fund might be better if you have a low-risk appetite.

- Investment horizon: How long do you plan to invest? Equity-oriented funds are more suitable for long-term goals.

Consulting a Financial Advisor

Hybrid funds offer a compelling option for investors seeking a balance between risk and return. However, choosing the right fund can take time and effort, given the various choices available. Consulting a qualified financial advisor can be beneficial. They can examine your risk tolerance, financial goals, and investment horizon to propose a hybrid or fund combination that will result in a great investment portfolio.