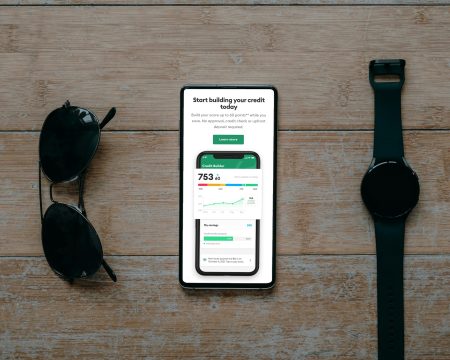

When was the last time you checked your credit score? For many people, checking their credit score usually only comes around when they need to purchase something on credit. They go to buy a home and they find out their credit score isn’t good enough to acquire the loan. Unfortunately, your credit score matters more than you may know. Thankfully, the number you currently have isn’t etched in stone and you do have the ability to improve it.

Organizing Your Life

When you live paycheck to paycheck and simply wing it when it comes to your bills, you put yourself at risk. As a direct result, you will make frequent late payments or even possibly fall behind for a month or two. And catching up on even one month of your bills is hard. The good news is that you can turn your life around and become responsible. Budgeting is essential to ensuring the funds are there when you need them and companies like Evernote can make hanging on to important documents, such as invoices, easy. Using their scan app, you simply scan the paper and store it for a future date. This will help eliminate the lost bills that cause you to miss payments.

Paying More for Everything

Having a poor credit score will ultimately cost you where it hurts the most: your wallet. You’ll pay higher interest fees and pay more for security and utility deposits. In addition, credit card and loan companies that are willing to grant you an approval will have much higher interest rates.

Getting Denied

As if the higher fees aren’t enough, having a bad credit score will also cause you to lose out on the best rates for things like insurance and cell phone service. A poor score may even prevent you from landing a good-paying job.

Turning the Corner

On the upside, you can improve your credit score. However, it will not happen overnight. In fact, it will more than likely take upwards of a year or more to get it to a respectable number, worthy in the eyes of a lender as a qualified candidate for a loan. Patience and perseverance are necessary to turn things around.

Starting Over

In order to begin the process of starting over, you will need to focus on the present. The bills that are in collection or severely behind will work against your score, even if you bring them current. So, while you will need to eventually address them too, you should put most of your efforts into paying your bills that are in good standing, on time. If you have many credit cards and loans, you have two options, you can take on a part-time job to bring in the extra funds necessary to catch them up, or you can try to consolidate them through a debt repair service.

Improving Your Credit Score

There are some things you can do to improve your credit score. For example, maxing out a credit card will lower your score. However, if you reduce the balance to less than half, you can raise your score by 20 or 30 points. How much debt you owe and the types of debt you owe also factor into your final score. So, focus your efforts on paying down your credit cards first, which will allow you to achieve a higher credit score sooner.

Maintaining a Good Credit Score

There are many financial advantages to maintaining a good credit score. Make sure that going forward, you pay your bills on time, and be mindful of where you spend your money. Additionally, you can acquire a free credit report once each year. Take advantage of that and monitor your score to avoid any inaccuracies that can lower your score.