Mental health is taking up a big percentage of disability insurance claims in Canada. Anxiety, depression, burnout, and stress-related disorders affect a growing number of working Canadians and frequently lead to extended time away from work.

Canadian insurance data from 2025 shows mental health conditions account for roughly 35% of new disability claims nationwide. These claims also represent close to 70% of total disability-related costs, driven largely by longer claim durations. Absences linked to psychological conditions often extend for months and, in some cases, years.

Long-term disability statistics reinforce the trend. By late 2024, mental health conditions made up close to 40% of long-term disability claims in Canada. Many of these claims involve professionals, office workers, and service employees facing sustained stress and workload pressure. Recovery timelines vary, which adds complexity for both claimants and insurers.

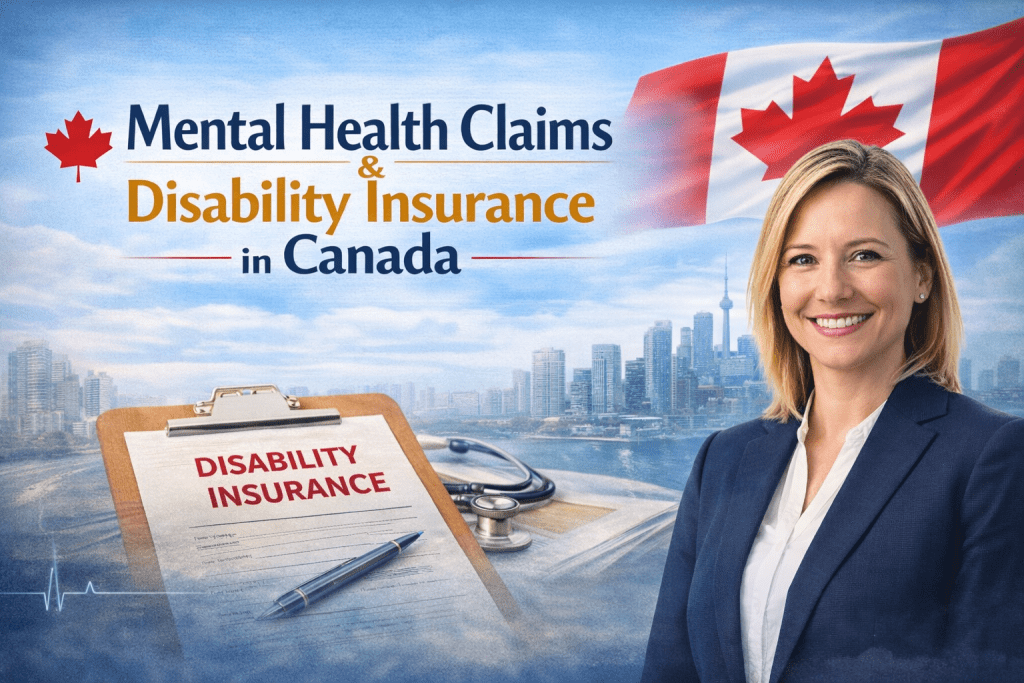

Mental health challenges affect a significant portion of the population. Statistics Canada reports that more than 10% of Canadians aged 15 and older live with a mental health-related disability that limits daily activities. For many individuals, those limitations directly affect job performance, attendance, and long-term employability.

Workplace pressure, financial strain, caregiving responsibility, and ongoing uncertainty influence mental health outcomes. These factors contribute to higher claim volumes and longer recovery periods. Disability insurance has become a reliable income protection tool during these absences.

Hamilton-based insurance advisor Lucy Lukic says many Canadians underestimate how mental health conditions interact with disability coverage. “Mental health claims often involve longer recovery periods and more documentation,” she says. “Understanding how a policy responds before a claim happens makes a meaningful difference.”

Policy structure impacts claim outcomes. Group disability plans vary in benefit duration, definitions of disability, and mental health limitations. Some plans cap benefits for psychological conditions or apply stricter criteria after an initial claim period. Employees often discover these details only after filing a claim.

“Group coverage can leave gaps. People assume income protection is automatic, but policy terms matter when someone is unable to work due to a mental health condition,” says Lukic.

Access to care also influences disability duration. Data from the Canadian Institute for Health Information shows that more than 40% of Canadians diagnosed with a mental health condition reported unmet or partially met care needs in 2024. Limited access to therapy, long wait times, and inconsistent treatment can slow recovery and delay return to work.

Extended time away from work puts financial pressure on households. Disability benefits typically replace only a portion of income. Mortgage payments, household expenses, and caregiving costs continue regardless of health status. Financial strain can add further stress during recovery.

Employers have expanded mental health support in recent years. Employee assistance programs, counselling benefits, and flexible work arrangements are now more common in workplace benefit packages. Early intervention programs aim to support employees before claims escalate into long-term absences.

Individual planning remains an important factor. Disability insurance decisions affect income stability during periods when employment becomes temporarily impossible. “Income protection needs to reflect real recovery timelines. Mental health conditions rarely follow a predictable schedule,” says Lukic.

January often prompts Canadians to review financial plans, benefits, and long-term security. Mental health trends have placed disability insurance firmly within those conversations. Coverage decisions increasingly reflect income protection needs linked to both physical and psychological health.

Mental health continues to influence disability insurance throughout Canada. Claim volumes, recovery duration, policy design, and access to care all affect outcomes for working Canadians. Understanding how disability coverage responds to mental health conditions remains a critical part of financial planning heading into 2026.