Life is unpredictable, and some of the surprises may not always be pleasant. Perhaps you must make a large medical bill, renovate your home, or fund your company. If you require cash, borrowing cash comes in handy. Not all loans, however, are good bargains. If you wish to borrow money without shelling out too much for interest, secured loans that offer low interest charges are an excellent idea.

In this blog, we will cover all you need to know about secured loans, such as how to obtain one at a low interest rate, where to apply online, and what to do if you are self-employed.

How to Get a Secured Loan at a Low Interest Rate

If you want a secured loan with a low interest rate, you need to show the lender that giving you money is not risky. Here are some ways to do that:

- Good Credit Score: Although it is easier to obtain secured loans, it is possible to secure the best interest rates with a good credit score. A good credit score indicates to the lender that you generally pay bills on time.

- Good Collateral: Whatever you provide as collateral makes a big difference. Items such as your home, property, vehicle, fixed deposits, or gold can be utilized. If what you provide is higher in value than the loan amount, the lender will be more inclined to offer you a low rate.

- Low Debt-to-Income Ratio: Banks verify that you use a small part of your income for loan payments. If you do not have large amounts of debt and your income is stable, it is more favorable to the lender. Pay off loans prior to making an application.

- Compare Lenders: All lenders do not provide the same offer. Compare interest rates at various banks, credit unions, and websites. Also, compare the fees and terms of the loans. Some websites allow you to compare rates without it having an adverse effect on your credit score.

- Shorter Loan Term: A shorter loan period normally entails you paying less interest in the long term. Your payments will be higher per month, but you will end up paying less in total.

Low-Interest Loans for Bad Credit with Collateral

If your credit score is poor, then you may struggle to obtain a loan, especially an unsecured loan. But with a secured loan, you have better prospects even with bad credit, since you are providing valuable collateral.

Since the lender has your asset in holding, they are less at risk. If you fail to pay back the loan, they can dispose of your asset and get their money back. That is why they are willing to lend to you, even if your credit is poor.

You may not get the lowest rates, but you will likely pay less than you would if you borrowed an unsecured loan. There are even lenders that do bad credit loans, you know. Just always make sure to compare and read all of the loan terms before you sign, though.

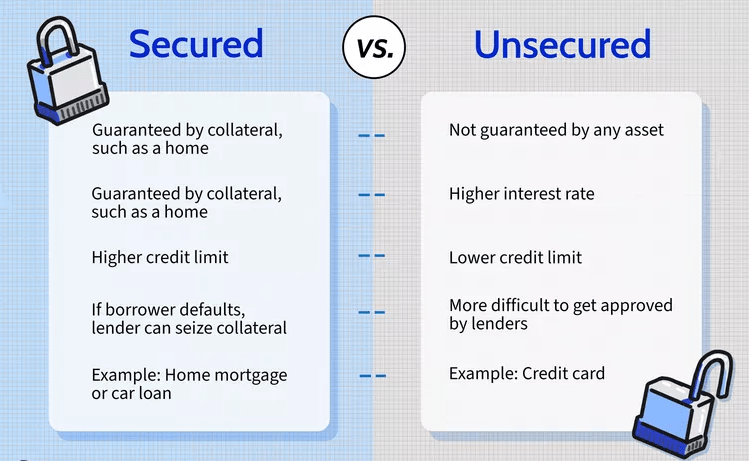

Secured Loans vs Unsecured Loans Interest Rates

The largest disparity between these two types of loans is collateral. This disparity influences how much interest you owe.

- Secured Loans: These are secured against something of value that you own. As the lender has the security of your asset against which to repossess if you do not pay back, they are less anxious and can offer lower interest rates. Examples include home loans and car loans.

- Unsecured Loans: These involve no collateral. The lender lends you money strictly based on your income and credit. That means they take many risks and usually charge a lot of interest. These loans offer lower amounts and terms for repayment. Some examples include personal loans, credit cards, and student loans.

Therefore, if you have something to your name of any worth, a secured loan will normally cost you less in interest.

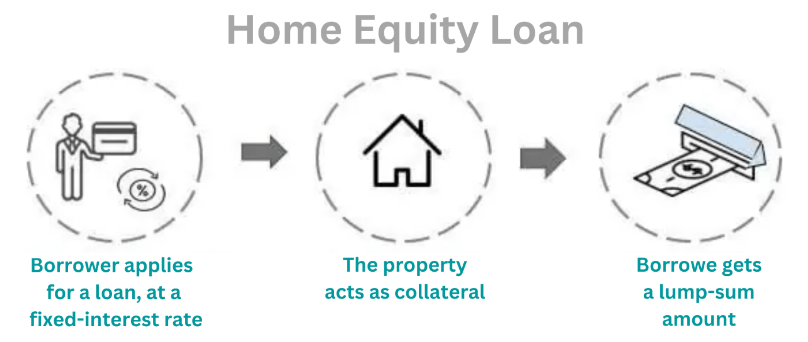

Home Equity Secured Loans with Low APR

Home equity loans are a wonderful type of secured loan that comes with very low Annual Percentage Rates (APR) as a rule.

- How They Work: A home equity loan allows you to borrow a fixed amount against your home’s equity. Your home serves as collateral.

- Why Low APR? Your house is substantially valuable, and the lenders can afford to give you a lower rate. These loans work great to pay off large bills like home improvements or when you want to settle other highly interest-related debt, or to help you pay college fees.

- Things to Consider: Although the interest is minimal, you are risking your home. If you can not repay, the bank may repossess your house. So, only borrow this kind of loan if you are certain you will be able to repay it.

- HELOCs: A Home Equity Line of Credit (HELOC) is similar in concept but operates like a credit card. You can borrow, repay, and borrow again within a specified time frame. HELOCs usually have variable rates, meaning the rate may be altered. Some lenders provide a fixed rate for the introductory period.

Where to Apply for Secured Loans Online

Nowadays, it is incredibly easy to obtain a secured loan online in the USA. This is where you can do it:

- Traditional Banks: Big traditional banks such as Wells Fargo, U.S. Bank, PNC Bank, Bank of America, and TD Bank allow you to apply for secured loans online. You can access their websites, obtain information regarding various terms on loans, and submit an online loan application form.

- Credit Unions: Your regional credit unions, such as Navy Federal Credit Union or Alliant Credit Union, typically offer excellent deals on secured loans. You typically can apply online if you are a member.

- Online Lending Marketplaces: Sites such as LendingTree, NerdWallet, or Bankrate allow you to compare quotes from numerous lenders all in one place. You input your information just once, and you can view various secured loan terms side by side. This allows you to get the best offer in a hurry.

- Direct Online Lenders: Some lenders do not have branches and do all their business online. Upgrade, LightStream (a subsidiary of Truist Bank), and Avant let you apply for secured or personal loans online. These lenders may be a good bargain because they have lower costs.

Online application saves time, allows for comparison, and usually enables you to qualify faster, all from home.

Best Banks for Secured Personal Loans

Most banks in the USA provide secured loans, but some of them have low interest rates and good customer service. Here are some of the best ones:

- Wells Fargo: A large bank in America, Wells Fargo provides personal loans that can be secured by a savings account or CD (Certificate of Deposit). They generally have low interest rates and friendly terms.

- U.S. Bank: U.S. Bank allows you to obtain a secured personal loan by putting a savings account or CD as collateral. They have quick approval and simple online applications.

- PNC Bank: PNC has secured personal loans with reasonable interest rates. You can place a PNC savings account or CD as collateral. They are also famous for good customer support and mobile banking facilities.

- Regions Bank: Regions Bank provides loans secured by your savings account or CD. They have straightforward terms and usually permit payoff early with no penalty.

- TD Bank: TD Bank provides secured personal loans and also has a very convenient online process. They also have flexible loan terms and amounts, making them a great choice for most borrowers.

Low Interest Rate Secured Loans for the Self-Employed

If you are self-employed, it is sometimes difficult to obtain a loan because your earnings can vary on a month-to-month basis. But secured loans can work well if you have valuable assets.

Types of Secured Loans for Self-Employed:

- Loan Against Property (LAP): You can pledge your home or business property as collateral. LAP can be taken for business purposes or personal use.

- Loan Against Gold: You can use your gold to obtain a quick loan at reasonable interest rates.

- Loan Against Securities/Fixed Deposits: You can borrow against your shares or mutual funds at low interest rates.

Conclusion

Secured loans are one of the smart ways and economical options for borrowing money if it is associated with a low interest rate. You can use your assets of value, maintain a high credit rating, and shop around between lenders until you sort out the best based on your requirements. When you do a job or manage your own business, you can borrow the money and meet the payments when due; time is a good tip to be a financially powerful person.