Managing money has evolved so much, hasn’t it? Not many years ago, all of us were jotting down expenses in notepads or attempting to decipher numerous rows of spreadsheet data. But today, in 2025, everything appears entirely different. Due to Artificial Intelligence (AI), budgeting software is intelligent, quick, and much more assistance-providing than it ever was.

However, with all the apps and tools available out there, picking the right one can be bewildering. Which AI budgeting tool should you entrust your finances to? What are the features that actually count?

Here, in this guide, we will get into what makes AI-driven budgeting tools so powerful today in 2025, how they can make your financial life easier, and what might be best for you.

Consider this your easy, nice guide to the top AI budgeting software of 2025, so you can save smarter, spend wisely, and remain worry-free about money.

Are AI-Powered Budgeting Tools?

AI-powered budgeting tools are intelligent apps that utilize artificial intelligence to guide you with your finances. Rather than putting down every single expense or estimating where your money is spent, these apps do all the legwork for you.

With an AI budgeting app, you can:

- Monitor spending in real-time

- Automatically categorize spending (such as food, rent, shopping, travel)

- Get notifications when you spend too much

- Establish savings goals and achieve them sooner

- Sync all your accounts in one place

The AI does not just monitor, it also analyzes your income and spending habits and forecasts future expenses. This makes budgeting smarter, easier, and more precise than ever.

Why 2025 Is the Year for AI Budgeting Apps

AI is revolutionizing personal finance in 2025, and here is why more individuals are making the change to these apps:

- Convenience: They link to thousands of banks and apps, meaning you never have to key in numbers.

- More savings: Many have reported saving additional money each month due to intelligent suggestions.

- Less financial anxiety: Predictions of future spending and reminders keep you from unwanted surprises.

- Customization: Each budget is one-of-a-kind, and AI ensures yours is customizedto your life, not a master plan template.

Actually, 2025 research reveals that 75% of users indicate that AI budgeting software made their personal finances stronger, and 60% saved more money.

Main Features of AI Budgeting Tools

Not all apps share identical features, but top AI-driven budgeting tools in 2025 typically have:

- Live updates so you are always aware of your balance.

- Personalized budgets that change as your spending patterns evolve.

- Predictive analytics to predict your future expenditure.

- Automation so that you never have to enter something manually.

- Scenario planning to try “what if” scenarios, such as a new salary or a large purchase.

- Warnings and reminders when you are close to overspending.

- Integration with banks, bills, and even investments.

- Goal tracking to assist you in saving for vacations, retirement, or paying off debt.

Best AI Budgeting Apps in 2025

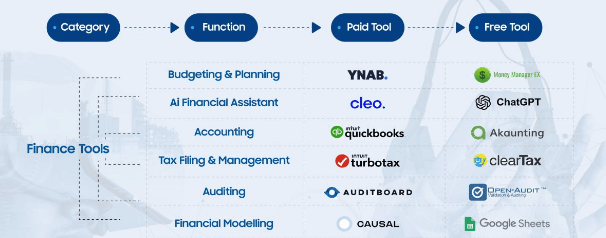

If you are curious which apps are worth trying this year, here are some favorites, each of which has its own strength:

- YNAB (You Need a Budget) – Best for people who want detailed, hands-on budgeting. It assigns every dollar a job and keeps you motivated with progress updates.

- Mint – Great free option for simple money tracking. It offers real-time budgets, AI savings tips, and goal tracking.

- Otio – Useful for students and researchers, with an AI workspace that includes personal finance tools.

- Docyt – Perfect for businesses and freelancers, offering AI bookkeeping, receipt management, and expense tracking.

- PocketGuard – Ideal for everyday personal use. Its “In My Pocket” feature shows exactly how much money you can safely spend.

- Personal Capital – Best for investors and retirement planners. It provides portfolio analysis, debt tools, and investment insights.

- Cleo – Fun, chatbot-style app popular with Gen Z. It chats with you, sets spending challenges, and gives witty money advice.

- Quicken – Great for advanced users who track multiple accounts, including crypto and retirement funds.

- Cube Financial – Business-focused, with strong forecasting and “what-if” planning features.

- SuperAGI Financial Assistant – Designed for tech enthusiasts, it offers advanced automation and high-level analytics.

Tip: Choose the app that matches your style. If you like control, YNAB might suit you. If you prefer a simple, set-and-forget tool, Mint is a better choice.

How Do AI Budgeting Tools Work?

It is easy to do:

- Link your accounts – Connect your bank, credit card, and investment accounts.

- AI categorizes expenses – The app teaches itself to classify items such as rent, groceries, and shopping.

- Live feedback – You see your budget and spending in real-time.

- Custom advice – The AI advises cutting back or saving in specific areas based on your behavior.

- Set targets – If you are saving for a holiday, repaying debt, or constructing an emergency fund, the AI tracks progress.

Why You Need to Test AI Budgeting Tools in 2025

Here is why thousands of individuals are converting this year:

- No more surprises – You will be aware when you are overspending prior to when it occurs.

- Automatic saving – Certain apps transfer money into savings for you, depending on your income and bills.

- Debt management – Receive tailored ways to pay off debt more quickly.

Conclusion

Budgeting with the help of AI-powered tools in 2025 is no longer a “nice-to-have”; it is becoming the new norm for personal money management. Such apps facilitate budgeting to become simpler, more intelligent, and more tailored than ever.

The greatest app is the one that you will use repeatedly. Experiment with one or two, decide which sits most comfortably with you, and have AI assist in creating stronger money habits. With the right tool, you will save more, worry less, and get back on track with your financial goals this year.