If you have ever bought something online or in a store and noticed the choice to “Buy Now, Pay Later” (BNPL), you know that it is a trendy way to purchase something without paying immediately. It is popular with many because it allows them to get something home today and pay for it later, often with no interest. It is a convenient choice for individuals who do not wish to or are unable to pay full price.

But here is some important information: from now on, selecting “Buy Now, Pay Later” will impact your credit score. You may be thinking, “What does that mean for me?” and “Should I continue to use BNPL?”

In this blog, we will discuss what this shift is about, why it is occurring, and how it may affect your money and credit. We will also offer advice on how to utilize BNPL responsibly.

What Is ‘Buy Now, Pay Later?

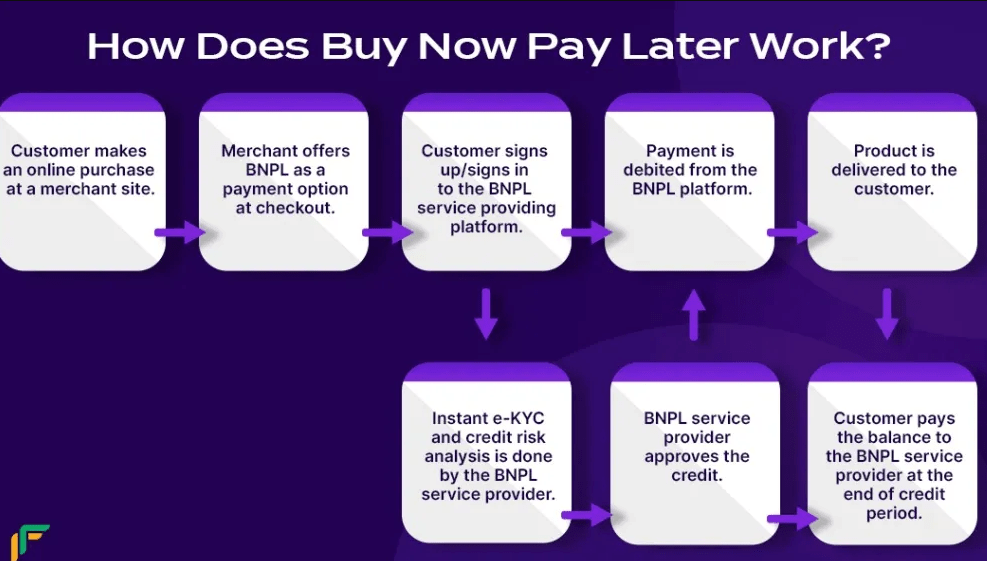

Before we get into the credit score section, let us ensure everybody gets BNPL. Buy Now, Pay Later is a payment plan that allows you to pay for a purchase in smaller installments over weeks or months. In some cases, those installments have no interest if paid on time.

As an example, if you purchase a $200 coat, you may pay $50 immediately and the balance over the course of several months. BNPL firms such as Afterpay, Klarna, and Affirm provide these services and are extremely popular among young consumers.

What Is a Credit Score and Why Does It Matter?

Your credit score is a figure that indicates to lenders how likely you are to repay money you borrow. It varies approximately from 300 to 850. The higher your score is, the more attractive you appear to banks and lenders.

A good credit score can also get you loans (such as an automobile loan or home loan) with a lower interest rate. It also influences whether you can get credit cards, rent an apartment, or even land some jobs. Generally, the majority of your credit score relies on paying bills and debts punctually.

How Did BNPL Affect Credit Scores Before?

In the past, most BNPL transactions did not impact credit scores. That is because a majority of BNPL firms did not report your payment history to credit bureaus, the organizations that gather information about your credit behavior.

This implied that if you made timely payments to your BNPL accounts, nothing would appear on your credit record. If you defaulted on payments, at times, it may not even impact your credit score, depending on the policy of the BNPL firm.

Since BNPL was “off the books” like this, yeah, it would not help you establish credit, but it also generally wouldn’t hurt your credit unless you had extremely bad unpaid debt that got sent out to collections.

What is Changing Now?

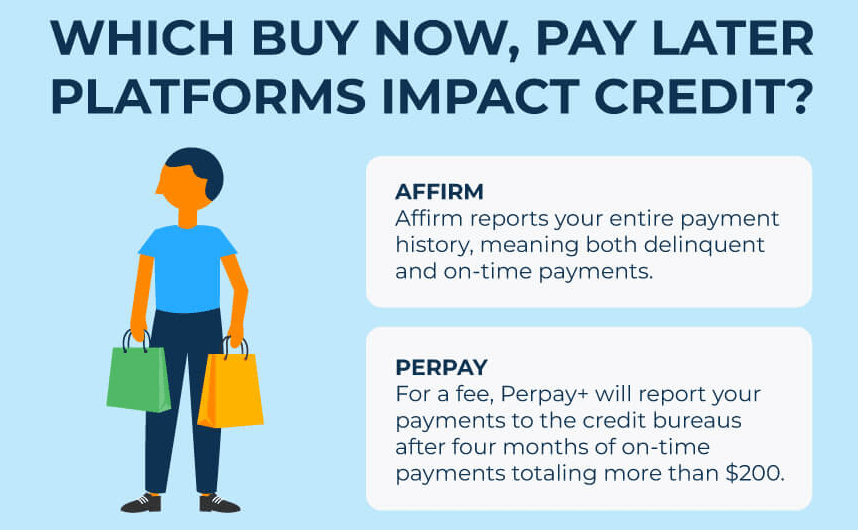

In recent times, BNPL businesses have begun reporting users’ payment history to credit bureaus. What this means is that the good news and bad news you make with BNPL payments will now be included in your credit score.

If you pay punctually and look after your BNPL accounts, it can boost your credit score. However, if you are missing payments or fail to stick to your payment schedule, it can decrease your credit score similarly to the way missing payments on a credit card would.

This is part of a larger effort to get BNPL services more transparent and responsible. Credit bureaus hope to ensure that these kinds of payments are reported on credit reports so lenders can get a complete view of your spending habits.

Why Is Buy Now, Pay Later at Checkout Important?

The fact that BNPL impacts your credit score makes individuals have to be more mindful about how they use this service.

Previously, you could use BNPL without caring about your credit record. Now, all payments will matter, positive or negative.

This shift can assist you in developing your credit if used responsibly. For a person with poor credit or no credit at all, it may be a means of gradually enhancing credit by making on-time payments.

But on the other hand, if you begin to miss payments or take on too many BNPL agreements, you may damage your credit score, making it more difficult to borrow money in the future for larger items such as a house or vehicle.

How Can You Use ‘Buy Now, Pay Later’ Responsibly?

With this new development, it is wise to stick to these guidelines when making use of BNPL:

- Know Your Budget: Make use of BNPL only for things you are certain you can pay in full on time. Do not overextend yourself with more than one BNPL plan.

- Read the Terms: Before opting for BNPL, read the terms and conditions. Understand when your payments are due and if there are late fees for missing payments.

- Set Reminders: Place your payment dates on a calendar or phone reminder. Timely payment will improve your credit score.

- Do not Use BNPL for Everything: BNPL is great for some buys, but using it for all your shopping could cause issues.

- Check Your Credit Report: Keep an eye on your credit report to observe how BNPL accounts look and make sure there are no errors.

What Should You Do Next?

If you are already using BNPL regularly, begin planning how to include it in your budget. If you are not a BNPL user, consider it wisely before you sign up now, since it has an impact on your credit.

Monitoring all your payment matters is more important than ever. A bit of extra attention can save you from damaged credit scores and additional charges.

Conclusion

“Buy Now, Pay Later” has simplified shopping and made it more convenient for most individuals. But as there is a recent modification involving BNPL payments in the computation of credit scores, it is best to exercise this option judiciously.

Timely payment of your BNPL accounts can now contribute to your credit building. Late payments will, instead, decrease your credit score. This shift promotes responsible consumption and can lead you to financial well-being.

Keep in mind that your credit score matters for what is ahead for you financially. Practice responsible use of BNPL, remain well-educated, and pay your bills on time.