If you spend a lot of money each month on groceries, gas, streaming services, and regular household bills, the Amex Blue Cash Preferred® Card can be a great everyday credit card. It gives high cash back on the things many families already buy.

However, this card is not for beginners. American Express expects your credit to be in good shape before you apply.

In this guide, you will learn:

- What credit score do you really need

- What “good credit” means in simple terms

- How to improve your opportunities before you apply

About the Amex Blue Cash Preferred Card

The Amex Blue Cash Preferred is a cash-back credit card from American Express. Instead of points or miles, you earn cash back that can be used as a statement credit or at checkout on sites like Amazon.

It is a spending card that targets day-to-day expenditure, which makes it popular among families and frequent shoppers.

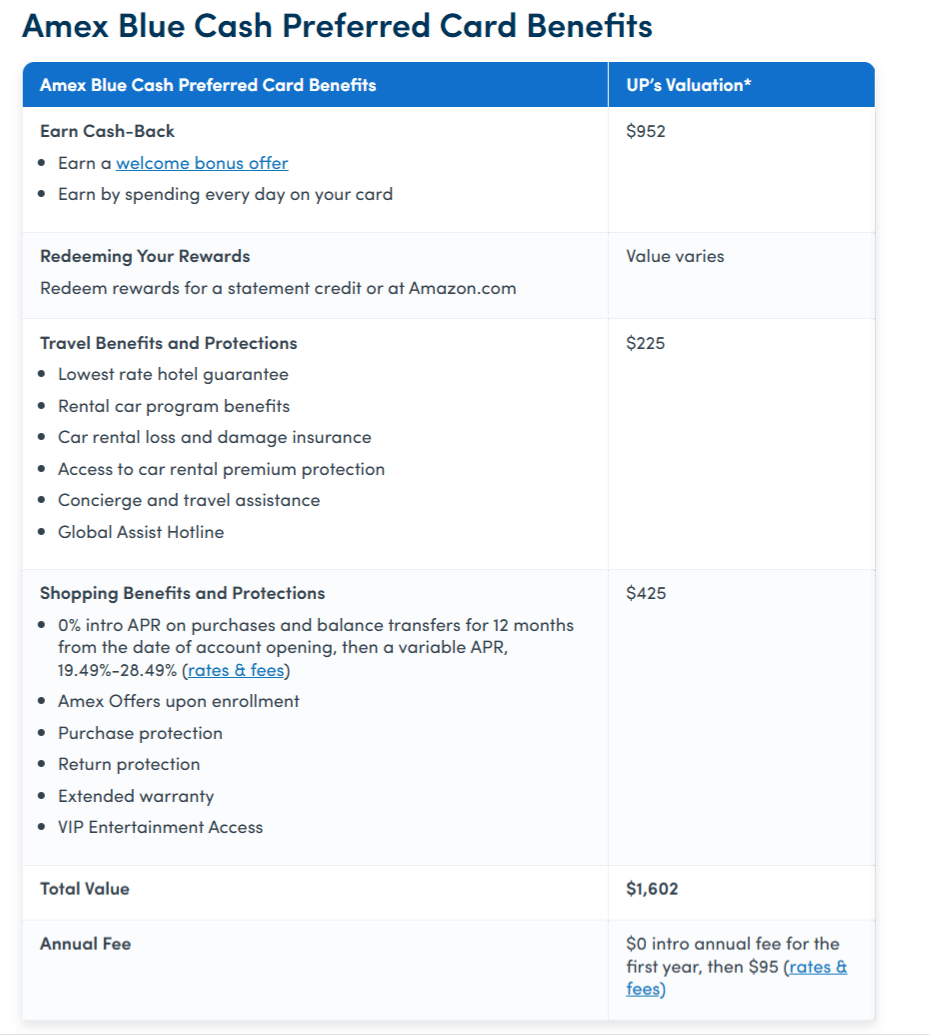

Key Benefits of the Amex Blue Cash Preferred

Here are the primary tips you get with this card:

- 6% cash back at U.S. supermarkets (up to $6,000 per year, then 1%)

- 6% cash back on select U.S. streaming services, including popular subscriptions

- 3% cash back at U.S. gas stations and on transit like buses, trains, rideshares, tolls, and parking

- 1% cash back on all other eligible purchases

Most new cardholders can also earn a welcome bonus, usually a statement credit after spending a certain amount in the first few months. The card does have an annual fee.

Credit Score Needed for Amex Blue Cash Preferred

American Express does not list an exact credit score requirement. However, most experts agree that you will need good to excellent credit to have a strong chance of approval.

In real terms, this usually means a FICO score of at least 670, with much better odds if your score is 700 or higher.

- Good: 670–739

- Very Good: 740–799

- Exceptional: 800–850

If your score is in the good range, like 680, 700, or 720, you may qualify, especially if the rest of your credit report looks healthy and your income is steady. If your score is very good or exceptional, your chances are usually better.

Keep in mind: even a 700+ score does not mean automatic approval. American Express does not just check the number without considering your entire credit profile.

Other Things Amex Looks at Besides Your Credit Score

When you apply for the Amex Blue Cash Preferred, American Express does a hard credit check. They look at a lot of sections of your credit report, not only your score. The following aspects are the primary ones that they tend to take into account:

Payment History

This is one of the most important parts. Amex wants to see that you pay your bills on time. Late payment, especially in the last 1–2 years, can hurt your chances, even if your score looks okay. A strong history of on-time payments shows Amex that you are responsible with credit.

Credit Utilization (How Much Credit You Use)

Credit utilization is how much of your available credit you are using right now.

Example:

If your total credit limit is $5,000 and your balances add up to $2,500, your utilization is 50%. Most experts recommend keeping utilization below 30%, and under 10% is even better.

Debt-to-Income Ratio (DTI)

DTI resembles how much debt you pay each month to how much income you earn. If a large part of your income already goes toward debt, Amex may worry that you can’t handle another card. A lower DTI shows you have more room in your budget.

Length of Credit History

American Express prefers to see a longer credit history. Older accounts show how you manage credit over time. If your credit file is very new and most accounts were opened recently, approval may be harder. Having older accounts in good standing usually helps.

Recent Credit Applications

Applying for many credit cards or loans in a short time can hurt your chances. Too many recent hard inquiries can make Amex think you are under financial stress or trying to borrow too much. Spacing out applications is usually a smarter move.

How to Check If You Are Ready to Apply for the Amex Blue Cash Preferred

Before you apply for the Amex Blue Cash Preferred® Card, it is a good idea to do a quick check of your credit and finances. This simple step can help you avoid a denial and may even improve your chances if you take a little time to prepare.

Check Your Current Credit Score

Start by glancing at your current credit score. This is generally available from your bank, credit card company, or other credit monitoring service with which you can be trusted.

If your score is below about 670, it may be smarter to wait and work on improving it before applying for this card.

Check Your Credit Utilization

Add up your total credit card limits and add them to your current balances. This tells you how much of your available credit you are using.

If you are using more than 30%, try paying down some balances before applying. Lower utilization can help raise your score and make you look less risky to American Express.

Look at Your Recent Credit Applications

Consider the number of credit cards or loans that you have applied for within the recent past. In case there are several of them in a short period of time, maybe it is better to have a break. Less recent tough investigations can cause your credit report to become more stable and responsible.

Conclusion

The Amex Blue Cash Preferred card is best for people with good to excellent credit who spend a lot on everyday items like groceries, streaming services, gas, and transit.

In simple terms, you should aim for a FICO score of at least 670, with even better chances when your score is closer to or above 700. The payment on time, minimal credit card account, and a moderate debt-to-income ratio contribute greatly.