In the modern world, finances might be scarce. You may encounter an emergency when you require immediate access to funds, such as for an unanticipated auto repair or a medical payment. But what if you don’t have a high credit score? Be at ease! You may still obtain a loan despite having terrible credit. This blog will walk you through various choices, pointers, and crucial considerations.

Know Your Credit Scores

Before we look at the options, let us know what credit scores are. It is a number that represents your worth in the light of credit. The score ranges from 300 to 850. There is no better saying than that: the higher, the better. If your score is below 580, then you have bad credit. Such a score will deny you loans from the usual lenders like banks.

Why Bad Credit Does Not Have to Stop You

Most persons with bad credit believe that nobody can lend them money. However, thousands of lenders offer loans to people with poor credit histories. They know that any person can be faced with difficult financial conditions. Here are some of the options you may look into:

Online Lenders

Online lenders have increasingly become the darling of people seeking quick loans over the last few years. Many of these lenders do offer personal loans, even to those people bearing bad credit. The process is also simple and fast. You can fill out an application online, and they will give you a decision within minutes. It is just important that you get to check on reviews on the lender so you know who you can trust.

Credit Unions

If you are a member of a credit union, they might also lend money to those whose credit may be poor. Credit unions are not-for-profit and, in general, have much more relaxed lending standards than banks do. And they may offer lower interest rates. Consider joining one if you’re not a member yet. Often, it’s quite easy to do and worth just gaining those options.

Peer-to-Peer Lending

Peer-to-peer lending websites connect borrowers with private investors. So, you can borrow from someone who might be able to take a risk on your credit. These kinds of loans are normally cheaper and come with looser requirements than traditional banks.

Secured Loans

You may also want a secured loan. This is one in which your asset is used as collateral for the loan. The beauty of that is that the lender takes less of a risk if you are unable to repay. They may be more likely to lend to you, even with poor credit. Just be aware that if you do not repay, you could lose the asset.

Co-signer loans

A good credit score will favor you when you find a friend or family member who enjoys good credit. Ask them to co-sign a loan for you. Co-signing is just an agreement to take up the responsibility of the loan, and if you cannot pay the installments, the co-signer is liable for it. Your chances of getting approved increase, and there may also be an opportunity to gain lower interest.

Important Points to Know

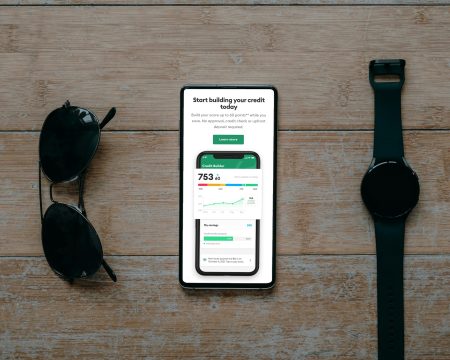

Image: Self.inc

While it is possible to obtain a bad credit loan, know this:

Interest Rates: You will pay higher interest rates. Lenders consider you more of a higher risk, which often means charging more for the loan. Be sure to see how much you will pay off in total.

Loan Amounts: You can only borrow a certain amount. Sometimes lenders will lowball loan amounts until you have established a track record of responsibly repaying loans.

Loan Terms: Be very careful when you borrow money. Some loans may have additional fees or penalties for early repayment. Always read the fine print before signing up.

Repayment Plan: Before you get a loan, create a budget so you can pay the installments punctually. Late payments will only worsen your credit score.

Improving Credit Over Time

Bad credit loans are typically a short-term solution. But to enhance your credit score in the long run, here are some more tips:

- Pay Bills on Time: Regular and timely payments can incrementally increase your score over time.

- Pay off debt: Pay off the debts you have accumulated. Keep an eye on your credit utilization and keep it below 30%.

- Check your credit report: Get a copy of your credit report and check for inaccuracies. Take steps to correct them immediately.

Types of Cash Loans

Two major types of programs for the cash loans industry that often accompany a payday loan are debt management and debt consolidation. Both of these programs negotiate restructured loan packages with creditors, often to the advantage of the borrower. If you can get a lower interest rate along with a short-term bridge loan, you have a much better chance of getting out of financial trouble than if a bank is constantly hitting you with late fees and interest rate hikes.

To find these programs, search the Better Business Bureau website for accredited financial services that emphasize borrowers with bad credit.

Yes, this industry is watchdog quite heavily by the BBB. The Better Business Bureau actually goes through the financial industry with a fine tooth comb. This means that if you find a financial services business with a high BBB ranking, it will pass muster.

Conclusion

It does not mean you are out of options when you happen to have bad credit and need the loan urgently. By choosing the right approach and knowing which options exist, you can find a solution that works for you.

Be careful and learn more of the terms to avoid getting into a cycle of debt. Improving your credit is very important for your future and could open several financial opportunities. So, if you need cash fast, try to do what you can do!