Mental health is taking up a big percentage of disability insurance claims in Canada. Anxiety, depression, burnout, and stress-related disorders affect a growing number of working Canadians and frequently lead…

Personal Finance

Life does not always go the way we plan. Maybe you lost your job. Maybe…

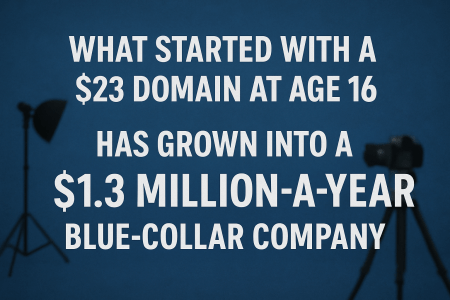

Ever caught yourself wondering how to fund your great business ideas? Do not worry, you…

Let us be real, money is scary. From trying to decipher investment jargon to simply…

Having a house may sound exciting, but it has a lot of responsibility attached to…

Trending Now

Bitcoin’s 2009 launch aimed to completely transform how individuals could access and manage their financial…

If you have made a few investments and had some success, you may be wondering…

In recent years, PAMM (Percentage Allocation Management Module) investments have experienced a surge in popularity…

Investments offer one of the most valuable tools for those who want to start creating…

News Focus

View MoreMental health is taking up a big percentage of disability insurance claims in Canada. Anxiety,…

Everyone at some point worries about what might happen to their loved ones if anything…

Recent Posts

Tokenized stocks fall under a broader category referred to as real-world assets (RWA). The market, according to research carried out by Standard Chartered Bank,…

Three Trump-linked altcoins generating the most buzz this September are World Liberty Financial (WLFI), Cronos (CRO), and the Official Trump meme coin (TRUMP). These…

Managing money has evolved so much, hasn’t it? Not many years ago, all of us were jotting down expenses in notepads or attempting to…

If you have ever bought something online or in a store and noticed the choice to “Buy Now, Pay Later” (BNPL), you know that…

Life does not always go the way we plan. Maybe you lost your job. Maybe you got sick. Or maybe your small business did…

Home loans have become a common route for financing residential purchases, and their popularity is evident as seen in recent data. Individual housing loans…

Latest Posts

Subscribe to Updates

Get the latest news.