A good credit score makes life a lot easier. However, that does not mean that your life is over if your credit is not good. Not only are options available when looking for an easy cash loan with bad credit, bad credit can be rebuilt into good credit over time.

Specifically, your credit score will increase while you take advantage of these five tips for dealing with a bad credit score:

Image: latimes

Pay off outstanding debts.

Your debt-to-income ratio is an important factor in evaluating your credit score. If you make large monthly payments on credit accounts but do not make a lot of money, your credit score will suffer. However, you may be able to boost your credit score relatively quickly if you pay down some debts. Focus on paying off debts over time if you have seen that your credit is bad and need to improve it as quickly as possible.

Make payments on time.

More than making payments is required when it comes to maximizing your credit score. You also need to make those payments on time if you want to avoid dings to your credit history. Every time you make a late payment, it is going to count against you. That is why you need to stay on top of approaching payment due dates. These days, you can set your smartphone to remind you of upcoming payments or even have your creditors send you reminders via email or text.

Avoid attempting to take out more loans or open more credit accounts.

Another thing that could potentially cause negative marks on your credit report is frequently applying for financing, so it is important to understand your credit report. The less often you apply for a loan, the stronger your finances are going to look to prospective lenders.

Opening up a new credit account will cause credit to take a small hit, but that is not all. It could also increase your overall debt load, making it more difficult for you to keep up with payments. To enjoy the best possible credit score, you should make every effort to avoid seeking financing unless it is necessary, or you may find yourself needing loans with bad credit.

Pay for things in cash.

Paying for things in cash can help you to minimize your debt load over time. Putting things on a credit card will increase your overall debt. The bigger your debt gets, the more difficult it is going to be to keep up with it. Remember that employers run credit checks. This means that you need to do everything you can to minimize your debt loan and make yourself more easily employable.

Increase your income

If your credit is not good, it usually indicates that you do not have enough money coming in every month to pay off all of your expenses. You can improve your credit by increasing your income. This will make more money available every month to meet your financial obligations and hopefully set a little extra money aside for savings. Building up your savings after you pay off all your bills every month is important if you are trying to raise your credit score.

Work with lenders who accommodate low credit scores

Some lenders specialize in assisting people with lower credit scores. They may offer smaller loans, or interest rates may be a little higher, but they may be flexible enough to allow you to access the amount you need. You can look for local credit unions, community banks, and even some online banks, as they normally have better reputations when it comes to being flexible than standard commercial banks. Compare their terms so that you will not fall into a trap of very high interest rates.

Researching Secured Credit Cards

Secured credit cards are a wonderful resource in the slow rebuilding of your credit. Since secured credit cards work by requiring a cash deposit, which is used as collateral and usually equates to your credit limit, there is a huge difference: secured credit cards report to credit bureaus exactly like a regular credit card. If you use your card wisely (having low balances and paying on time), you can rebuild your credit score and, therefore, your financial standing highly.

Negotiate Your Bills and Interest Rates

Few realize that negotiations can be done with creditors and service providers. Those who have credit cards with high interest rates can negotiate with the lender for a lower rate. Most companies are yielding more than most people consider if you have, in recent times, shown a willingness to pay on time. This will make your monthly payments easier and help you avoid more debt.

Negotiate with utility providers, internet providers, and phone companies. Some of them will be willing to work with you and offer a better rate or even create a payment arrangement to help reduce the burden.

Seek Rent-to-Own Arrangements

If bad credit makes it challenging to secure a place to live, rent-to-own may be a great option. This allows you to rent a house with full knowledge that at the end of the rental term, you will be able to purchase that house. In many cases, your rental payments will be used to accumulate towards your down payment, affording you the possibility of repairing your credit during the time that you are working toward owning the home.

Some furniture and electronics stores also offer rent-to-own plans so you can acquire your necessities without piling up credit card debts. Just make sure to read the terms carefully as some rent-to-own plans have hidden fees or very high interest if in case you miss a payment.

Pay Utility Bills on Time

Paying utility bills on time is a small thing, but it really does make a huge difference in your financial standing. Some utility suppliers even report payment histories to the credit bureaus, which means you gain some points as time goes by. Consistency also means steady finances and prevents one from slipping into debt spiral traps.

Set up automatic payments to pay bills or sign up for a plan that will automatically transfer funds to help you stay current on your balance and avoid late fees and penalties from your banks and service providers.

Attempt to find programs that offer financial assistance

Federal and state programs exist to help in case of an economic reversal; among them are housing, grocery, or utility cost subsidies. Relief relief on essential spending can free up more cash for other financial responsibilities if one has access to SNAP (Supplemental Nutrition Assistance Program), LIHEAP (Low-Income Home Energy Assistance Program), or Medicaid.

Create an Emergency Fund, No Matter How Small

An emergency fund serves as a good hedge against further debt. Begin by taking even the smallest amount of each paycheck—no—no sum is too insignificant. Saving even $20 a month can really add up over time. This fund will protect you against unexpected expenses and will not tempt you to use credit when you need it.

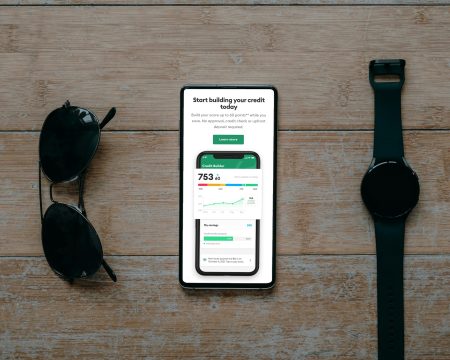

Improve Your Credit Score with Credit Builder Loans

Image: thebalancemoney

Credit builder loans are loans for people with poor credit that allow them to build a good payment history. The loan is usually small, and the money flows directly into a savings account that can only be accessed once all payments are made. This way, you will have a chance to establish a good payment history without being charged any interest; thus, you get a better score in the long run.

Fortunately, most community banks, credit unions, and online lenders provide credit builder loans, which are accessible for restoring individuals’ credit profiles.

Monitor your credit report

One proactive way to improve your financial health is to keep an eye on your credit report. Then, you will know precisely what factors to expect when calculating your score, including inaccuracies. Yo are also entitled to one free credit report from each of the three major credit bureaus every year. Correct any inaccuracies you find because the erroneous removal of such information can help lift your score.

There are many free credit monitoring services online that also allow you to receive alerts when your report has changed. This information helps keep you abreast of changes over time and helps detect fraud early.

Conclusion

Having a poor credit score is not the end of your financial journey. You can re-establish your credit, but with strategic planning and the right resources, you begin making financial progress while rebuilding your credit. Look for ways to manage your existing financial obligations, keep up to date with options available, and become strategic in winning small financial victories. With continued effort, you will get by and lay a much stronger foundation for a better future financially.